If you’re a small business owner, I’m sure you have heard a lot about how important keeping track of your expenses are.

Maybe you’ve asked yourself some of the following questions:

- What are financial statements?

- How do I read my business’ financial statements?

If this is the case for you, then look no further because I am going to cover all of this in an easy to digest way so by the end of reading this article you will feel 100% confident in understanding your financial statements as a small business owner!

Let’s start with the basics: what are financial statements?

Financial statements play 2 big roles: the reporting role and the operational role. The reporting role is for business and tax purposes to meet guidelines. The operational role requires more details and is used for decision making.

The Income Statement

Also known as the profit and loss statement, the income statement tells you whether your business has made money or not. It reports financial performance over a specific accounting period and focuses on your business’ revenues and expenses during a specific period of time. It is important to create an income statement every month while documenting the period date on your income statement.

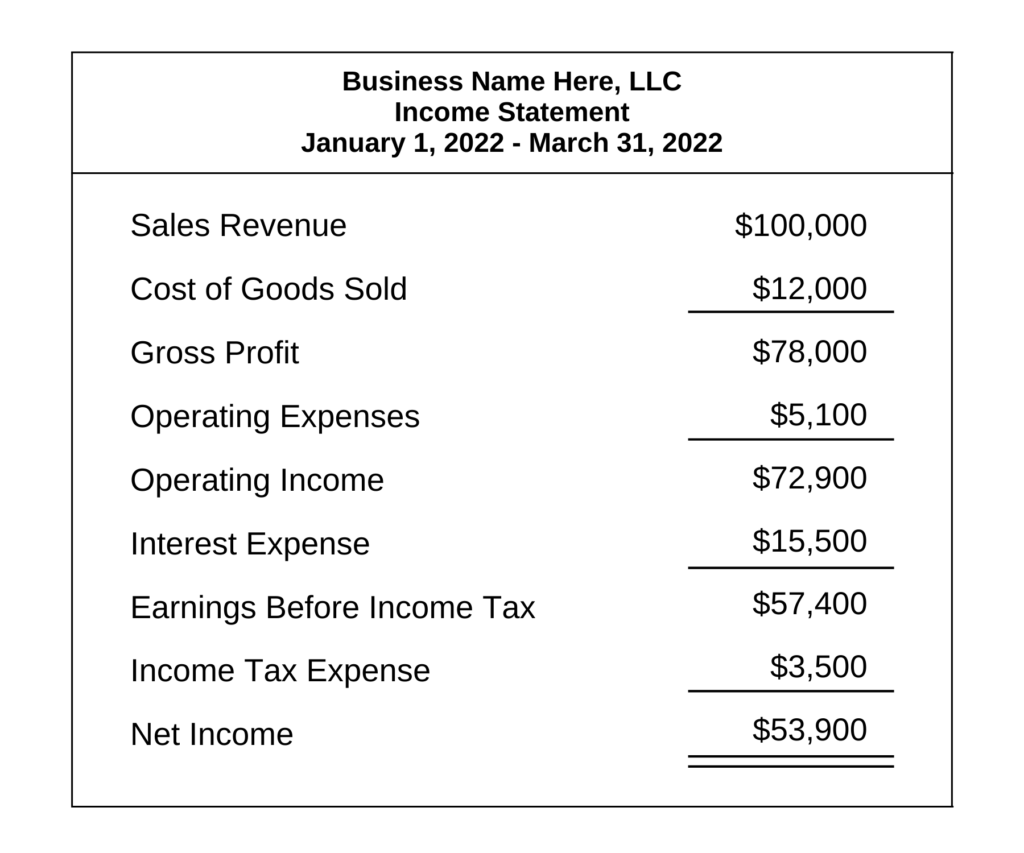

A common template structure for creating an income statement is showed below:

(note: the income statement below is strictly for example purposes only, the numbers are not accurate)

- The revenue represents how much money your business earns. Pretty simple, right?

- The cost of goods sold (COGS) represents the cost of making and distributing your product or service. This does not include other expenses such as utilities, but only the direct cost of materials and supplies needed to create what you’re selling.

- The gross profit represents how profitable your products or services are. This can be found by subtracting the cost of goods sold from your revenue.

- The operating expenses represent all other costs and expenses spent by your business. This is also known as overhead. Examples include rent, utilities, taxes, employee wages, travel fees, office supplies, etc.

- The operating income or loss can be found by subtracting operating expenses from the gross profit. This represents how profitable your business is and how good you are at making money with your business.

- Next comes the taxes and non-operating expenses section which is pretty self explanatory.

- Followed by your net income which is what you walk away with after everything is paid for.

The Balance Sheet

The balance sheet reports a company’s assets, liabilities, and equity. In other words, it evaluates your company’s capital structure and rates of return for potential investors. The balance sheet is used to calculate important financial ratios which can determine the overall health of your company.

The balance sheet is usually prepared every quarter (depending on your business size and the amount of moving assets). The main importance of this financial statement is to show you the assets you own and the debts you owe.

Balance Sheet Equation:

Assets – Liabilities = Equity

Assets reported on the balance sheet include cash, business equipment, inventory, patents, etc. While the liabilities reported include credit card debt, accrued expenses such as rent, utilities, taxes, employee wages, etc. Your business equity is the remaining value after the equation has been completed. In most cases, what’s left is your common stocks and retained earnings (also known as your net income after dividends are paid).

The balance sheet is normally a little more complex to put together, but I always recommend downloading a free template you can find online and adjusting it as needed.

The Cash Flow Statement

The cash flow statement is a financial statement that summarizes the movement of cash that comes and goes from your business.

The cash flow statement takes information from your income statement and balance sheet to design a way that is easy for you to follow exactly where your money is going. This is the third leg of the stool here to the big three.

This financial statement paints a picture as to how your company’s operations are running and how money is being spent while telling you where all cash is coming from. Cash flow statements are also used for determining how much cash is available to see how well your business is able to pay for your operating expenses and any debts you may have.

The 3 main parts of the financial statement are cash flow from operating activities, investing activities, and financing activities. Two different methods can be used for determining the exact amount of cash flow on hand for your business: the direct cash flow method and indirect cash flow method.

To Wrap Everything Up…

All three of your business’ financial statements work together to provide useful information on the financial performance of your company. It is very important to accurately report your numbers on all three statements since they are often audited by government agencies, your accountant, and any other firms to ensure they are accurate for financing, investing, and tax purposes.